The FATF on Covid-19 and Compliance

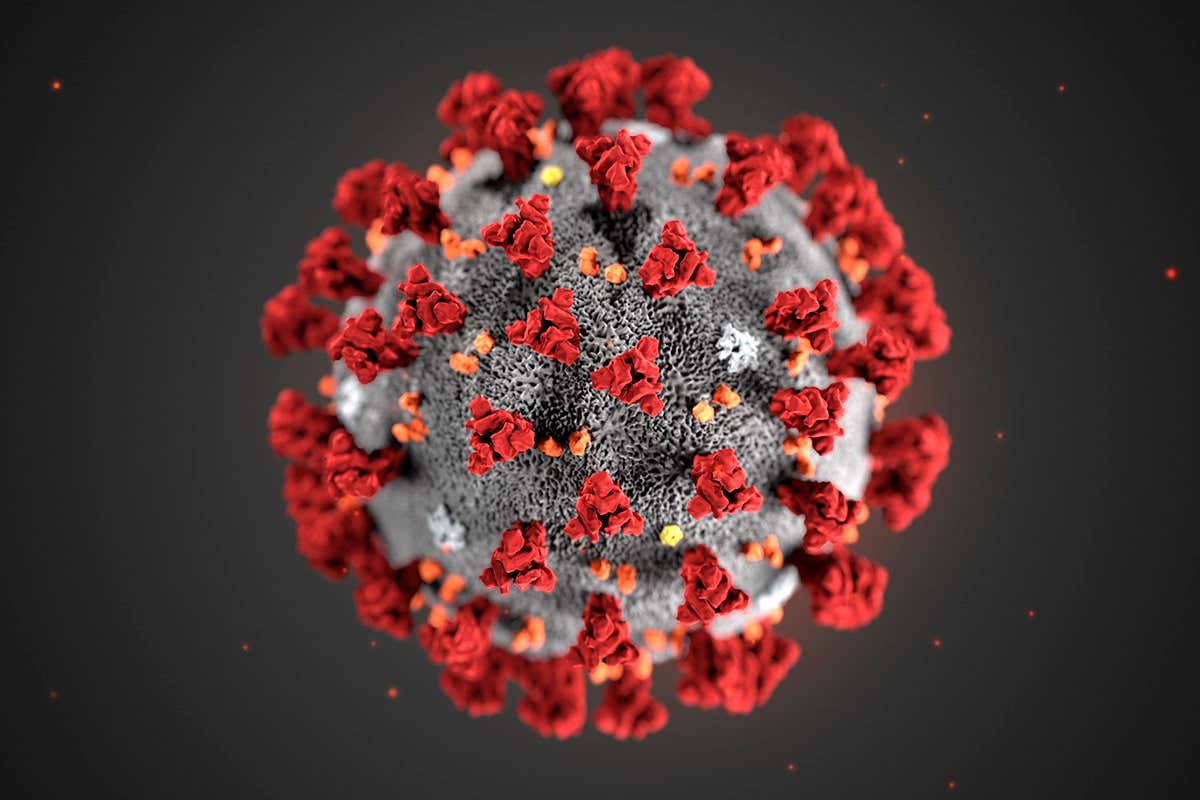

Covid-19 has definitely made life a bit tough for most of us and the regulatory world. There are a lot of challenges Governments and financial bodies are currently facing in order to fight financial crime and money laundering. There have been several cases of illicit financial practices, terrorist financing, fraud and data breaches made during this pandemic which needs to be taken care of immediately. Covid-19 has greatly impacted the ability to perform regulatory functions and supervise policy reforms.

Criminals will always find creative new ways to get away from due diligence checks by exploiting the current remote working situation by moving money around to cover their illicit source of funds. The fact that several charitable trusts, relief funds and emergency aids have been set up in developed and developing countries for coronavirus is an easy target for criminals to use those funds to conceal their laundered money.

To address these issues the Financial Action task Force (FATF) has issued a summary of guidelines and recommendations that highlight some of these concerns. The FATF noted that due to remote working, lack of onsite inspections for due diligence measures, there will be delays in executing corrective actions case of any compliance breach. This is probably the reason why countries with a lower capacity and funding to do so have completely locked down and shut their operations.

The FATF encourages its member nations to tighten their risk mitigation measures, organise and systemise information to protect sensitive data, scrutinise transactions that involve a bigger amount or seem suspicious and prioritise the fact that there will be delays in response from Covid-19 patients who will not be available for providing necessary information while ongoing monitoring measures take place.

Apart from this, the FAFT advises better coordination between domestic and private sectors, usage of the risk-based approach, and digitisation of banking. One of the main takeaways from the guidance paper would be the encouragement to use digital identity technology to ensure safety for electronic transactions and client onboarding. The Financial Conduct Authority, in the UK has encouraged firms to accept scanned documentation on their applications or via email, selfies as identification and multi-factor authentication access via codes for increased protection.

Please note that all opinions made on this blog should be treated as a guide and not legal advice.